Expanding into the Americas: The Value of an Employer of Record (EOR)

26 Sept, 202512:20Key Takeaways for Businesses Exploring EOR in the Americas: An Employer of Record (EOR)...

Key Takeaways for Businesses Exploring EOR in the Americas:

- An Employer of Record (EOR) enables companies to hire talent in the Americas without establishing a local entity.

- EOR models offer speed, compliance, and cost efficiency, making them valuable for North America and Latin America’s diverse regulatory environments.

- Companies gain competitive advantages via risk mitigation, local compliance, quick onboarding, and scalable solutions tailored to each country’s complexities.

- EOR assumes all legal employer responsibilities, ideal for companies without the budget or technical know-how to set up a legal infrastructure.

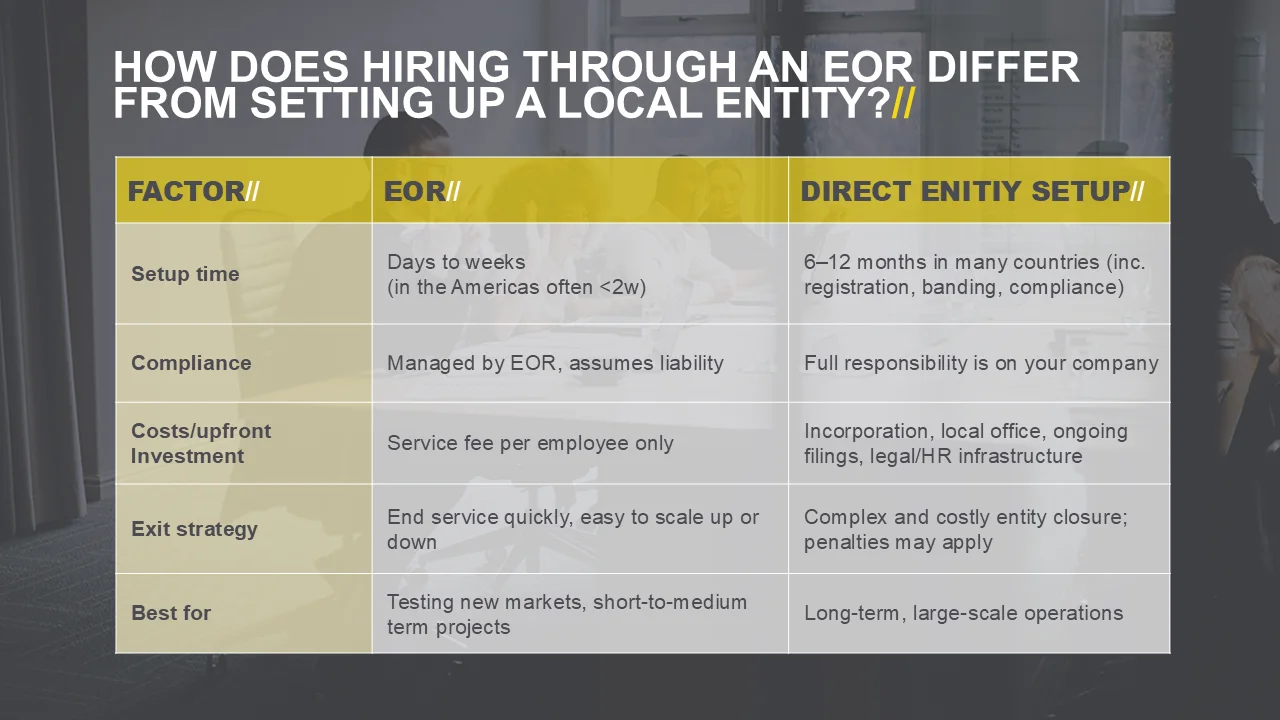

Expanding your workforce into the Americas can be complex and costly if you set up a legal entity in every new market. An EOR offers a faster, compliant, and cost-effective route, enabling you to hire personnel in the U.S., Canada, Latin America, and the Caribbean without the burden of local incorporation.

What is Employer of Record (EOR) and Why Does It Matter in the Americas?

An Employer of Record (EOR) is a third-party employment organization that legally hires workers on your behalf in a foreign market, where you don’t have an existing entity. You keep authority over operations and deliverables, while the EOR handles payroll, taxation, social security payments, compliance, and HR administration.

In the Americas, EOR services are valuable because:

- Labor laws vary widely from “at-will” employment in the U.S. to rigid termination protections outside of it. In the U.S., employers and employees are generally allowed to terminate the relationship with minimal notice and without cause. However, in other countries, strict labor protections are enforced, requiring formal procedures and just cause for termination.

- Many energy and industrial projects operate across multiple jurisdictions, e.g. from Alberta’s oil sands to offshore platforms in Suriname, requiring quick, compliant access to skilled talent.

- Setting up and retiring entities is expensive and time-consuming, especially for short-to-medium-term projects.

Deploying EOR can be a highly strategic move for companies looking to expand across the region or take on new projects. It allows international companies to obtain a global workforce without establishing a legal entity in every country.

Global EOR Landscape & How the Americas Fit

Driven mostly by cross-border demand for flexible and compliant hiring solutions, the worldwide EOR market is growing. Although historically tech firms have dominated EOR usage in Europe and Asia, energy and industrial sectors drive expansion in the Americas, the Middle East, and Africa.

Global Trends:

- The global Employer of Record (EOR) market was valued at USD 5.23 billion in 2024 and is projected to reach USD 9.17 billion by 2033, reflecting a CAGR of 6.8%.

- North America accounts for 41% of the global EOR market share, followed by Europe (28%) and Asia-Pacific (22%).

- Growth is driven by demand for remote workforce management, regulatory compliance, and flexible hiring solutions across multinational organizations.

Americas Fit:

The Americas are increasingly strategic for EOR due to:

- Cross-border hiring demand (e.g., an interrelated supply and demand between US and Canada), especially among SMBs and energy firms.

- Resource-driven expansion in LATAM (e.g., Brazil’s pre-salt oil fields - projected to generate over R$17 billion from upcoming auctions - and Suriname’s offshore reserves, including the $10.5 billion GranMorgu development).

- Political and economic shifts encourage companies to diversify operations and mitigate costly risks.

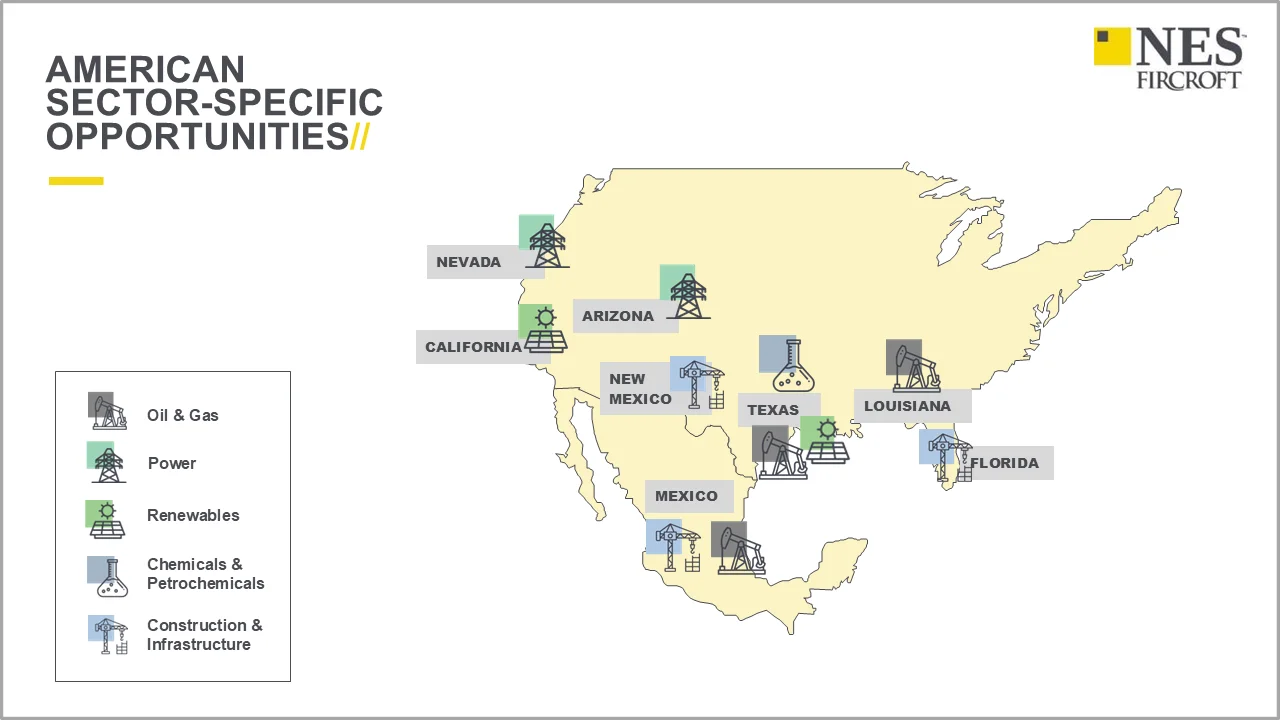

Emerging EOR Opportunities in the Americas

The Americas region presents a mix of mature markets and frontier economies, making it ideal for EOR deployment.

Key Opportunity Zones:

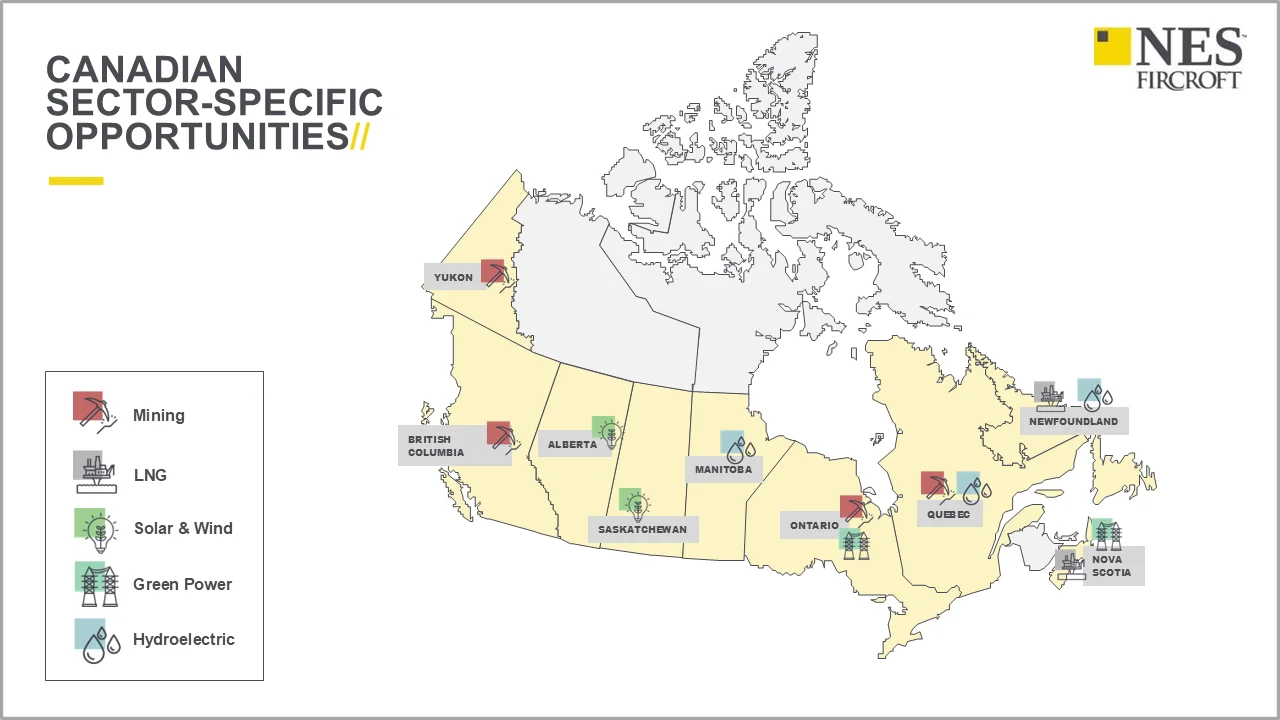

Canada ↔ US Cross-Border Hiring

North America’s tightly integrated labor market presents a compelling case for EOR.

- U.S. companies hire Canadian professionals to mitigate tariff exposure, reduce regulatory friction, and access a highly skilled workforce, particularly in STEM and professional services.

- Roughly 1 in 10 Canadians work for U.S.-affiliated firms, while tens of thousands of Americans and non-citizen residents hold temporary work permits in Canada – 76% and 67% respectively.

- With Canadian immigration tightening (capped at 367,750 foreign workers in 2025), EOR offers a solution for managing talent mobility and remote employment across borders.

- Remote contracting is surging. EOR providers help firms navigate tax, compliance, and payroll complexities without requiring relocation or entity formations.

- Companies turn to Canada to bypass U.S. trade volatility, access a multilingual and highly educated workforce, and benefit from a stable, business-friendly environment. EOR solutions in Canada enable fast, compliant hiring, ideal for global firms expanding into North America.

Uruguay and Suriname

These emerging markets are gaining traction for energy exploration, creating new demand for agile workforce solutions.

- Uruguay has licensed all offshore blocks to major energy players, targeting oil and offshore wind development.

- Suriname is drilling three major offshore wells in 2025, with an estimated yield of 900 million barrels of oil equivalent.

- EOR enables quick, compliant market entry, ideal for energy companies needing to deploy specialized workforces without tackling complex incorporation processes.

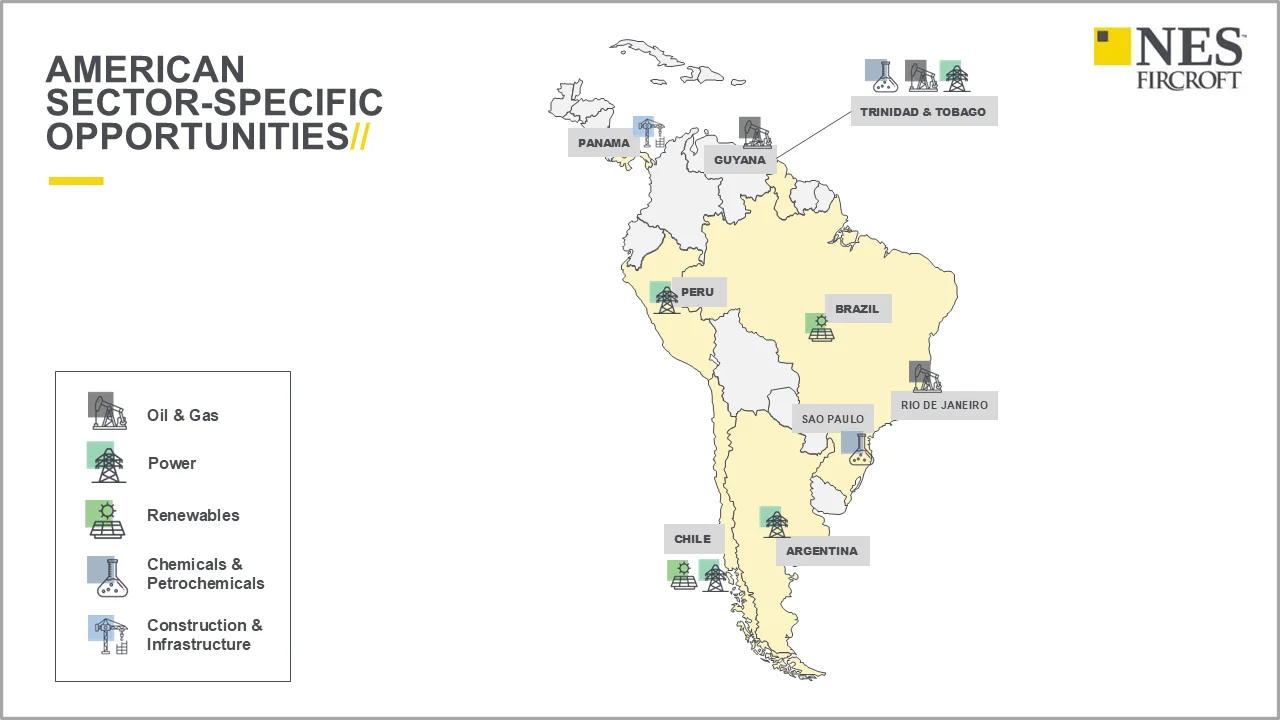

Brazil, Argentina and Guyana

Latin America’s largest economies offer scale but also regulatory hurdles that make EOR a strategic necessity.

- Brazil’s offshore reserves reached 416.5 bcm in 2024, with 85.8% of natural gas production coming from offshore fields. However, overlapping laws such as the Pre-Salt and New Gas Law complicate direct hiring.

- Argentina’s labor environment is challenging, with evolving regulations and high inflation impacting payroll management.

- EOR simplifies workforce deployment in both countries, offering legal clarity, payroll stability, and operational speed.

Trending Challenges in the Region

Despite its advantages, EOR in the Americas has region-specific challenges that companies must address.

Misunderstanding of Employment Laws:

Many US-based companies operate under the assumption that “at-will” employment applies globally. Still, most countries across the Americas region enforce rigid labor protections that make hiring and termination more complex. EORs save businesses from expensive mistakes in foreign legal systems. Some examples are:

- Brazil: Employers must pay a 13th-month salary (Gratificação de Natal), vacation pay with a one-third bonus and follow strict dismissal guidelines. Termination without cause requires advance notice, typically 30 days, severance pay including FGTS contributions, and documentation.

- Mexico: Under the Federal Labor Law (Ley Federal del Trabajo), employees are entitled to profit-sharing (PTU), which is a mandatory annual distribution of company profits, and severance pay, which is up to three months’ salary plus 20 days per year of service and a seniority premium (12 days per year). Wrongful termination can lead to reinstatement or compensation.

- Canada: Employment standards vary by province. Quebec demands contributions to the Quebec Pension Plan (QPP) and enforces French-language workplace policies, while Ontario requires vacation pay (minimum 4-6%), public holiday pay, and notice of termination.

- Argentina: Employers in Argentina must abide by collective bargaining agreements (CBAs) that define industry-wide criteria. Pay severance equal to one month’s salary per year of service, plus unused vacation and Aguinaldo (13th-month bonus).

- United States: Even though “at-will” employment is widely practiced, employment laws in the U.S. are shaped by a layered system of federal, state, and local regulations. Minimum wage, overtime eligibility, and paid leave differ from one state to another.

- Guyana: Guyana has a complex regulatory environment where international companies without a local entity face significant hurdles in navigating Guyana’s Local Content Act, including restrictions on hiring, procurement, and service delivery, which can delay operations and increase compliance risks.

Permanent Establishment (PE) Risk:

Hiring employees in a foreign country without a registered entity can lead to permanent establishment (PE) status, exposing companies to corporate tax liabilities and VAT requirements. Many territories have threshold criteria in their tax regulations and double tax agreements to determine whether a business has a taxable presence. The risk of PE status has grown due to new global business models and increased worker mobility. This is especially acute when:

- Employees negotiate contracts, generate revenue, or represent the company publicly.

- Local tax authorities interpret staff presence as a sign of ongoing operations.

With the EOR being the legal employer, companies are essentially shielded from PE exposure and can carry out compliant workforce expansion.

Worker Classification Crackdowns:

Countries are tightening enforcement on contractor misclassification due to tax evasion and labor rights concerns. It’s the responsibility of the employer to categorize employees as full-time/part-time/independent contractors following local laws; however, requirements for these classifications vary across countries. Misclassification may result in penalties such as retroactive tax payments, unpaid benefits, lawsuits, lost income, and a decline in employee morale. EOR services offer a structure for accurately assessing how each worker should be classified, ensuring the process is handled correctly and compliantly. This helps minimize the risk of fines and damage to reputation.

Cost Barriers for SMBs:

For small and mid-sized businesses, setting up a legal entity for just a few hires is financially impractical and can be prohibitive to business operations. Entity registration involves difficulties such as legal incorporation fees, tax filings and audits, local banking and accounting infrastructure, and eventual dissolution costs if operations cease. EOR offers a cost-effective alternative, allowing companies to scale up or down without long-term commitments.

How are Employer Obligations Split Between You and the EOR?

EOR Responsibilities:

- Legal employer of record

- Payroll processing and currency conversion

- Tax and social security compliance

- Employment contracts aligned with local law

- Benefits administration

Your Responsibilities:

- Operational management and work assignments

- Strategic decisions on hiring and termination (EOR implements them compliantly)

- Funding the payroll and service fees

When to Use an EOR

- Testing market entry without committing to incorporation

- Short-term contracts or pilot projects

- Hiring one or two employees to build client relationships

- Employing remote workers in states and countries where you have no registration

NES Fircroft: Hire Globally and Stay Compliant

Expanding into new markets shouldn’t mean compromising on speed, compliance, or control. Our EOR solution empowers you to build and manage your international workforce confidently. We have legal entities across 45 countries, with a strong presence in the Americas. Our teams are familiar with the subtleties of every market, from onboarding and payroll to navigating burdensome local regulations, enabling you to grow your business and employ qualified professionals anywhere in the world.

Looking to simplify your global hiring strategy across the Americas? Contact our team to explore how our EOR service can support your workforce goals.