Gas and LNG Industry Predictions for 2023

15 Feb, 20239.48The story of LNG globally in 2022 was full of twists and turns. Europe saw a sudden need to...

The story of LNG globally in 2022 was full of twists and turns. Europe saw a sudden need to reduce its reliance on Russian exports through a mix of EU sanctions, a shutdown of the Nord Stream 2 pipeline, and changes to the country’s own export rules in the wake of the conflict in Ukraine.

And while the headlines of the LNG market have certainly been centred around eastern Europe, the industry globally has faced challenges and changes.

The industry was also in the wake of the COVID-19 pandemic, with global supplies affected by transport and logistic issues as supply lines looked to re-stabilise.

In the US, record prices have been driven up through supply chain issues and increased production costs, and as a significant exporter, those prices have had a knock-on effect elsewhere.

In reaction to higher prices, importers have sought to lower their costs by reducing their imported gas, looking at alternatives, or developing longer-term contracts to stabilise the costs and improve value. Despite these changes, gas consumption, production, and export volumes broke all records in 2022.

So, what does this mean for the LNG industry globally and for each region? And how is this likely to develop across 2023? We've looked at some of the reports around the key developments in the industry through 2022 and the most knowledgeable industry predictions.

Europe experienced a 65% increase in LNG cargo imports in 2022

In the first nine months of 2022, Europe adapted to a change in the energy mix. For the first half of the year up to October, countries across the EU sought to increase LNG's imports and storage capacity.

As a result, European countries collectively imported 9.34mt of LNG in December 2022 and 94.73mt in 2022. This was supported by a 65% increase in LNG cargo imports in the first nine months of 2022 alone.

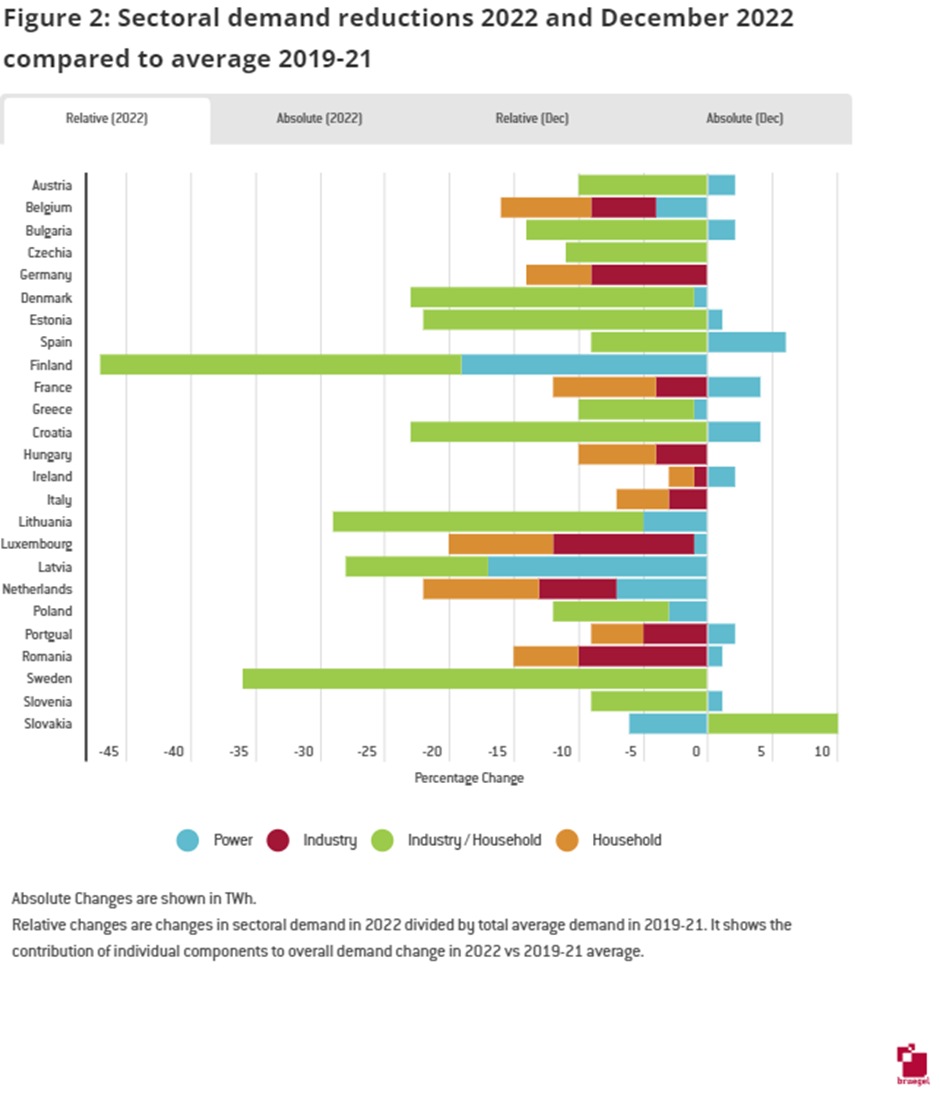

Despite this increase in imports, LNG demand decreased by 50bcm in 2022, equivalent to 10% compared to 2021. The increased energy cost has driven many countries to reduce their usage or rely on alternative energy sources where possible.

Europe has also been upgrading its import and storage capacity to store imported LNG, with EU gas storage at 87% capacity by the end of September 2022. The UK has been recommissioning gas storage facilities. Following a cold spell in early December, the weather across Europe has become milder, driving down demand and prices. Maintaining this storage level will be crucial in ensuring energy security and lowering costs.

Source: Bruegel

The United States saw a boom in the production and export of LNG

US natural gas production reached record highs in 2022, partly due to increased gas usage over coal due to coal prices and relative stockpile shortages, with gas taking over coal as the primary power source in the country.

Gas consumption in the US was also up an estimated 6% as demand for air-conditioning grew during the third hottest summer on record.

In 2022, production of natural gas from dry sources reached 98 billion ft3/d, which was greater than the highest level recorded in 2021 by 3.5 billion ft3/d. This was mainly due to increased production from the Permian and Haynesville regions.

LNG exports are likely to triple over the next decade, with the recently published Inflation Reduction Act designed to support local energy over imports boosting the demand for LNG. The US LNG market is set to support 29bcfd of production into 2023.

In terms of exports, the US also accounted for most of the long-term LNG contracts signed in 2022, the largest of those contracts being to supply 2.1mtpa of LNG between 2026-2046 to Royal Dutch Shell.

Qatar led the Middle East’s liquefaction capacity

In the Middle East, Qatar leads the Middle East’s liquefaction capacity at 76.5% with 78mtpa capacity, out of a total of 101.3mtpa across the whole of the middle east. Oman ranked second with 11mptpa, and Yemen at third, 7mtpa, contributing 6%.

Qatar and Oman have been working throughout 2022 and into 2023 on major LNG export contracts to Asian markets with countries including China, Japan, and Korea. Qatar, in particular, aware of the US's dominant position in the market, is instead turning to nearby Asian markets, with QatarEnergy signing a 27-year contract with China – far beyond China's decarbonisation goal of 2030, and one of the most significant contracts in LNG's history.

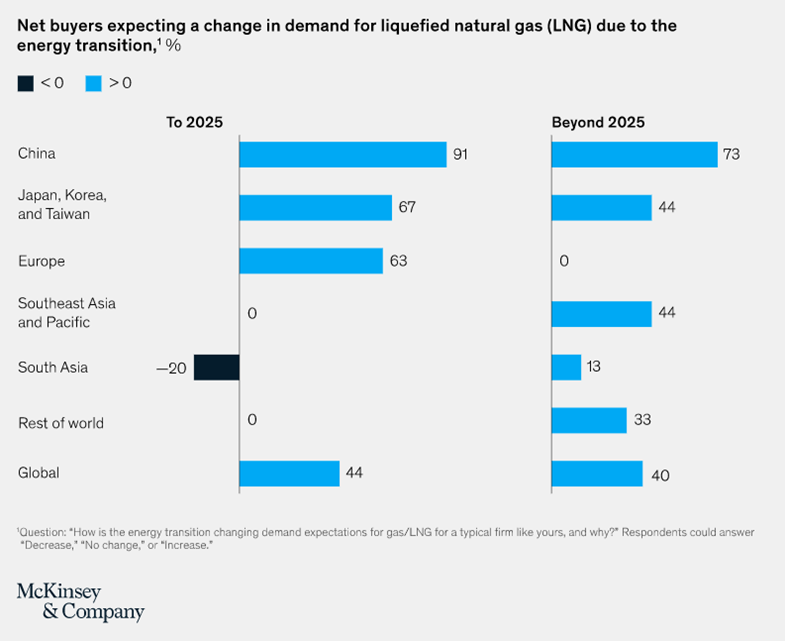

China looked to lower its reliance on LNG

China is looking to lower its reliance on LNG with its renewables targets, while Japan is seeking to increase its nuclear capacity to reduce its reliance on imported LNG. India has also increased its renewables targets in response to a volatile year. (https://ieefa.org/resources/asias-lower-lng-demand-2022-highlights-challenges-industry-growth)

India has also adjusted the balance in favour of coal power generation over gas in the wake of increased LNG prices. Industrial gas consumption in industrial sectors was also down by 23% in 2022, oil consumption rose by 11%, and coal power generation increased by 9% over the same period.

Meanwhile, Japan is looking to restart up to seven nuclear reactors by the summer of 2023 to reduce its dependence on imported LNG and mitigate the risks of a volatile gas market.

Two countries in Asia that have particularly struggled with the volatile market were Pakistan and Bangladesh. The rising cost of spot LNG has made imports prohibitively expensive, with rolling blackouts and power cuts becoming common through the latter half of 2022 in both countries. In Pakistan, oil-fired power had increased five-fold while reduced working hours, limiting operating hours for industrial businesses, and early store closures were adopted to limit power usage.

Top LNG trends to watch in 2023

Source: McKinsey

Unpredictability in Europe

Two elements will largely dominate the market: the ability of exporters to produce gas and the ability of importers to store it. In Europe, demand is also a driving factor – a cold end to the winter could see LNG reserves drop as low as 19%, preventing inventories from restocking beyond 73% by November 2023. If the winter is milder and assuming new FLNGs and terminals are commissioned, this will help to push prices down in 2023 as the EU is more likely to reach its storage targets of 90%.

While this means Europe is in a better position than was feared through the first half of 2022, there are still uncertainties that will control the price and availability of gas supplies into the winter of 2023.

US LNG export capability will flatline in 2023 and grow again in 2024, but production will accelerate

Data from S&P Global shows that US LNG terminals have been running close to capacity throughout 2022, with demand reaching around 11.5 Bcf/d. This is despite the explosion and fire at the Freeport LNG plant pushing 2Bcf/d of gas back into the domestic market.

Growth in domestic gas production capacity is expected to slow through 2023 as new facilities are developed. Prices at Henry Hub are expected to average $5.47/MMBtu across 2023 after reaching a high of $6.65/MMBtu during 2022. Beyond 2023, production capacity will again increase as new facilities like the Golden Pass facility in Texas go into production.

Demand in China is expected to rise with the lifting of COVID restrictions

China's industrial demand for natural gas fell during recent COVID outbreaks and lockdowns, but with the lockdowns easing as 2023 progresses and production increases, so will the demand for energy. The rise in this demand will depend on various factors, including how quickly the production and industrial economy returns.

The effects could be minor if the rollback of COVID restrictions is slow but could be much more significant if lifting restrictions results in faster economic growth.

The weather will also play a part; last year saw record heatwaves in China, resulting in power cuts in regions such as the Sichuan region, where hydropower constitutes 80% of the energy mix. Droughts in similar heat in 2023 will increase the country's reliance on gas power, pushing demand.

LNG FIDs set to grow the market

With a gap of 140bcm from gas no longer in the pipeline from Russia, the race is on to replace these supplies. 2022 saw just 28 mmtpa of LNG sanctioned, but 2023/2024 is a different story, with more than 200 mmtpa of LNG supply seeking FID.

According to a recent report by Wood Mackenzie, Not all of these will pass, but two significant projects include the second phase of Venture Global's Plaquemines (6.7 mmtpa) and Sempra's Port Arthur LNG (13.6 mmtpa). The Port Arthur project is expecting FID in Q1 of 2023.

Some additional FIDs looking for sanctioning in 2023 include the following;

· Energy Transfer’s Lake Charles (16.5 mmtpa)

· Next Decade’s Rio Grande (16.5 mmtpa)

· Venture Global’s Calcasieu Pass Phase 2 (10 mmtpa)

· Sempra’s Cameron Phase 2 (6.2 mmtpa).

CCS technology will support decarbonising LNG and reduce greenhouse gas emissions during production

Despite the recent global events changing the marketplace predictions across 2022, the challenge of tackling climate change and previously agreed commitments towards reducing emissions remain.

The EU’s RePowerEU initiative, the Inflation Reduction Act (IRA) in the US, China's Five Year Plan, and the Paris Agreement all seek to push the green transition forward. Carbon Capture and Storage will be critical to countries meeting these goals when LNG has become the short-term response to the energy crisis.

The technology behind CCS is still relatively new, with existing facilities only able to capture 50 Mtpa of CO2. Huge investment drives the technology forward to improve methane capture above 1 Btpa.

The IRA offers 12 years' tax credits for CCS projects in the US, from US$50/tCO2 to US$85/tCO2, with direct payments for the first five years.

And in Europe, the industry is more advanced, with more substantial investment. Carbon prices sit at around US$100/tCO2 and are expected to continue to grow. Some governments are also offering 'contract for difference' style agreements for power plants to bridge the gap between carbon prices and the cost of CCS.

The Global CCS Institute has reported that out of 196 projects since 2022, 30 are in operation, with 11 under construction and 153 in development.

A regularly updated map by Zep currently shows 66 market-ready projects on track to become operational by 2030.

Summary

2022 has been a volatile year for the LNG industry, and our blog only covers some likely changes in 2023. The most apparent predictions are that prices may come down depending on the weather – cold winters and extreme heat in 2023 will increase the world's reliance on gas.

Investment in the LNG industry is set to grow in the short term. Still, that industry must also keep to its climate commitments, and it can only achieve that through parallel investment in CCS technology and facilities.

Finding your next LNG role with NES Fircroft

NES Fircroft has been recruiting engineering and technical professionals for global oil & gas jobs since 1970. Our recruiters source candidates for some of the most significant energy projects worldwide, with jobs available across various industry verticals.

Through tailored workforce solutions, we’ll help energy clients to staff their projects, and through demonstrable experience (we’re proud to look after over 12,500 contractors), our discipline-specific recruiters will help support contractors on their assignments and assist candidates in preparing for the job market.