Top Data Centre Projects in APAC

03 Feb, 202611:30Key Takeaways: Explosive growth but a looming supply gap: APAC’s data centre capacity i...

Key Takeaways:

- Explosive growth but a looming supply gap: APAC’s data centre capacity is projected to double to around 30GW by 2027/2028, but the region is expected to face a supply shortage of 15–25GW by 2028, driven by surging demand for cloud computing, AI and digital services.

- Major infrastructure investments across diverse markets: Landmark projects include Bitdeer’s 500MW Bitcoin mining facility in Bhutan and Google’s proposed 1GW AI data centre in Visakhapatnam, India, demonstrating the scale and geographical spread of development.

- Tokyo maintains dominance while South-east Asia accelerates: Greater Tokyo retains its position as APAC's leading market with 1160MW operational capacity, while Malaysia and Indonesia are experiencing the fastest growth rates, attracting operators through competitive power costs, available land and supportive government frameworks.

- Johor, Malaysia, is emerging as a 1GW market: In just six months, Johor added 160MW of new operational capacity, while future growth plans suggest it will reach 1GW by the end of 2026, highlighting the shift towards emerging locations.

- Talent acquisition emerges as critical bottleneck: Intensifying competition for qualified data centre professionals – such as electrical, mechanical and network engineers – has made partnering with a specialist recruitment agency essential for complex infrastructure delivery.

The APAC region has emerged as a vital hub for data centre development, driven by the exponential growth of cloud computing, AI and digital services. As organisations across APAC migrate operations to the cloud and consumers demand increasingly complex digital experiences, the infrastructure supporting this revolution requires significant expansion.

Growth in Demand and Supply

During the first half of 2025, APAC added nearly 2.3GW to its development pipeline, according to a recent report. The region now has an operational capacity of around 12.7GW, with 3.2GW under construction and a further 13.3GW in planning stages.

Looking ahead, APAC data centre capacity is projected to double to around 30GW by 2027/2028. Despite this, a supply shortage of around 15–25GW by 2028 is forecast.

This surge in demand reflects multiple converging factors:

- Rapidly growing internet penetration across South-east Asia

- The proliferation of 5G networks

- Increasingly stringent data sovereignty regulations requiring localised storage

- The positioning of APAC nations as manufacturing and technology hubs for global enterprises

Countries including Japan, China, Singapore, Australia, India and Malaysia are experiencing particularly strong activity. Tokyo remains the powerhouse data centre market in APAC, with recent constructions and acquisitions in Inzai and Kanagawa. Meanwhile, emerging markets such as Indonesia and Thailand are capturing attention as operators seek to identify alternative locations with lower costs and supportive government policies.

Alongside this infrastructure expansion, data centre recruitment has intensified, with demand for technical talent often outpacing supply across many markets. As projects scale in size and complexity, employers increasingly turn to specialist data centre recruitment agencies to identify professionals who possess the skills needed to deliver projects successfully.

Five Major Data Centre Projects Reshaping the Region

1. Bitdeer Jigmeling, Bhutan

Bitdeer Jigmeling (500 MW – the largest in South Asia) is a Bitcoin mining data centre currently under development, expected to reach full capacity by early 2026. It’s part of a US$500 million partnership, taking advantage of Bhutan’s abundant green hydropower, offering lower power costs and higher efficiency.

2. Huawei Global Yun Data Centre, China

This is Huawei’s largest global data centre (200 MW – the largest in East Asia), which began operations in 2020. The facility is designed to eventually host one million servers.

It covers 480,000 m2 across three zones with 51 buildings, including nine dedicated data centre facilities and 42 supporting structures.

3. AirTrunk’s MEL 1 Melbourne Hyperscale Data Centre, Australia

AirTrunk’s MEL1 Melbourne facility represents Oceania’s largest data centre at 185+MW.

The project addresses Australia’s growing demand for cloud services and positions Melbourne as a key location in the country’s digital infrastructure. Construction of the six phases began in 2017. The first phase is now operational, and subsequent stages are under development to accommodate major cloud service providers expanding their Australian presence.

AirTrunk has also established other notable data centres in the region, such as SYD1 Sydney West (130MW).

4. Facebook’s Tanjong Kling Data Centre, Singapore

Facebook’s data centre at Tanjong Kling is the largest in Southeast Asia at 120MW.

It was designed with a focus on energy efficiency by minimising the use of land, energy and water. Facebook also highlighted that important factors for choosing the sites of its data centres are locations with “robust infrastructure, an excellent local talent pool and great community partners”.

5. Google’s proposed 1GW data centre in Visakhapatnam, India

A Google subsidiary, Raiden Infotech India Private Limited, has recently proposed a 1GW AI data centre in Visakhapatnam, which – if approval is granted – will be the largest in Asia.

Detailed proposals have been submitted for the development of three data centre campuses at a cost of around $10 billion, with the first phase of construction to be completed within 2.5 years and operations potentially beginning in July 2028.

APAC Data Centre Capacity and Market Leaders

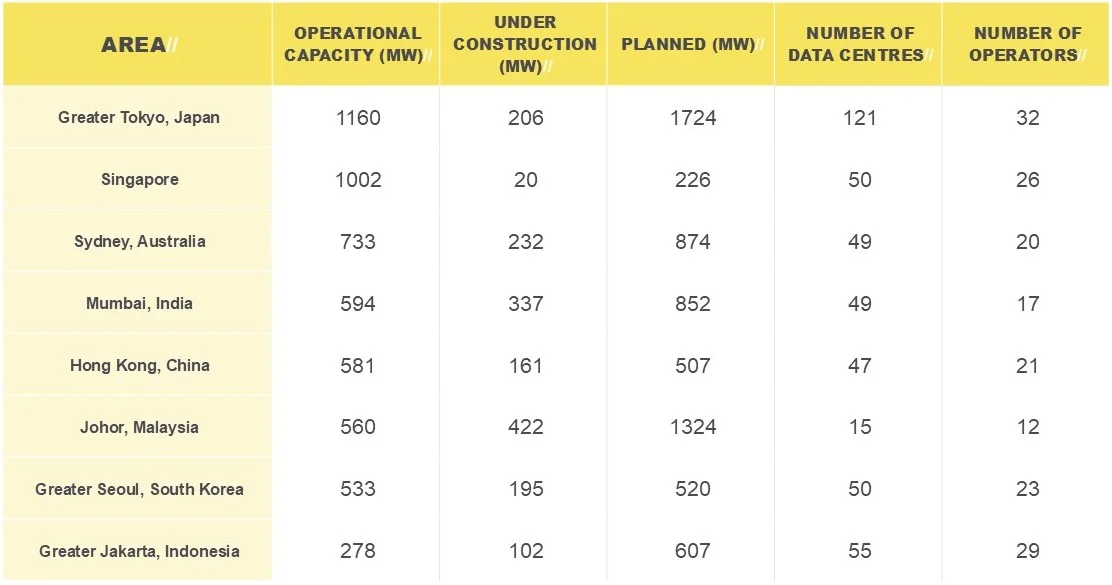

The following table summarises operational and planned data centre capacity across APAC’s primary markets:

(Source: Data derived from Cushman & Wakefield, APAC Data Centre H1 2025 Update, 30 October 2025)

Greater Tokyo remains the “powerhouse” market in APAC. In particular, Inzai hosts the largest cluster in Tokyo with 32% of operational capacity and 44% of the development pipeline.

In just six months, Johor has added 160MW of new operational capacity, while under-construction capacity has increased by 87% to 422MW and planned capacity has increased by 61% to 1324MW. This means Johor is likely to become a 1GW market by the end of 2026.

This data illustrates the concentration of existing capacity in mature markets while also highlighting the substantial pipeline of development in emerging locations. Malaysia and Indonesia stand out for their planned capacity additions, reflecting the strategic shift towards markets offering space, power availability and competitive operational costs.

Securing the Best Talent

As data centre projects grow across APAC, the competition for qualified professionals has intensified considerably. From electrical engineers and mechanical specialists to project managers and data centre technicians, the sector is seeking individuals with specific technical competencies and relevant certifications. Data centre jobs span multiple disciplines. Identifying candidates who combine technical expertise with regional knowledge presents a significant challenge for employers.

NES Fircroft has extensive experience in data centre recruitment, supporting both operators and contractors in building high-performing teams capable of delivering complex infrastructure projects. Our approach begins with understanding the specific requirements of each role and the broader project context, enabling us to identify professionals whose skills and experience align with client’s needs. We have an established presence across Asia and Australasia, backed by a global footprint. Our on-the-ground teams, located in key regional data centre hubs, enable us to engage effectively with local markets, ensuring you can quickly and compliantly access the very best talent.

Whether you’re an employer needing to strengthen your project team or a professional exploring opportunities in this expanding sector, we can provide the specialist data centre knowledge and far-reaching networks required for successful outcomes.

If you’re looking for data centre recruitment support, please contact our specialist team to discuss your requirements. Candidates interested in exploring data centre jobs across the APAC region can browse our current vacancies and register to apply.

FAQs

How many data centres are in APAC?

The Asia-Pacific region hosts over 1800 data centres, ranging from small enterprise facilities to hyperscale operations exceeding 100MW. The exact figure fluctuates as new facilities become operational and older ones are decommissioned. Major concentrations exist in established markets including Japan, China, Australia and Singapore.

Which countries in APAC are experiencing the fastest growth in data centre development?

Malaysia and Indonesia are experiencing particularly rapid growth, with substantial capacity additions announced by major operators attracted by available land, competitive power costs and supportive government policies. India also demonstrates an exceptional growth rate, driven by its enormous domestic market and increasing enterprise cloud adoption. Thailand and the Philippines are emerging as alternative markets capturing increased operator interest.

What is data centre recruitment?

Data centre recruitment refers to the specialised process of identifying, attracting and securing professionals with the technical expertise required for data centre construction, operations and management. It requires an understanding of specific technical certifications, industry standards and the operational requirements of mission-critical infrastructure.

Why should you partner with a specialist data centre recruitment agency?

A specialist data centre recruitment agency, such as NES Fircroft, possesses deep knowledge of technical requirements, industry certifications and the specific skill sets that differentiate the top candidates. A specialist agency maintains extensive networks of qualified professionals, understands regional salary benchmarks and market conditions, and can significantly reduce time-to-hire for critical positions.

What challenges do employers face when hiring for data centre projects in APAC?

Employers encounter challenges related to limited talent pools for highly specialised roles, intense competition from multiple projects, salary inflation in expanding markets, and complexities around cross-border hiring and work permits.

What types of jobs are available in data centres?

Technical roles include:

- Electrical and Mechanical Engineers (Critical Infrastructure) – Senior and lead-level engineers responsible for the design, delivery and integrity of mission-critical electrical and mechanical systems, including power, cooling, redundancy and critical plant.

- Commissioning Managers, CxA and IST specialists – Client- and contractor-side specialists accountable for commissioning strategy, integrated systems testing, and safe and compliant transition from build to live operations.

- BMS, EPMS and Controls experts – Control systems and integration specialists covering building management, power monitoring, DCIM and end-to-end visibility of critical infrastructure performance.

- Facilities Managers and Operations Leaders – Operational leaders responsible for 24/7 uptime, SLA-driven performance, maintenance strategy and site-level operations in live data centre environments.

- Licensed and statutory roles – Certified and legally mandated personnel required to operate, maintain and supervise critical electrical and life-safety systems in compliance with local regulations.