Navigating the Challenges of Global Payroll: How an EOR Can Be Your Solution

31 Aug, 20236:30In today's globalised world, businesses are expanding their reach and hiring employees from ...

In today's globalised world, businesses are expanding their reach and hiring employees from different countries to gain a competitive edge. However, managing global payroll can be a complex and challenging task. From complying with local tax regulations to navigating diverse employment laws, companies face numerous obstacles when paying their international teams accurately and on time.

In this article, we explore the challenges of global payroll and how an Employer of Record (EOR) can help businesses overcome them.

Understanding Global Payroll and its Challenges

Global payroll refers to the process of managing and processing employee compensation and benefits for a global workforce whilst adhering to local tax laws and regulations. Unlike domestic payroll, global payroll involves dealing with various countries, each with its own set of rules and requirements.

Managing global payroll can be overwhelming for businesses, especially those without experience in international payroll processing. The complexities arise from the following:

- Compliance: Ensuring compliance with various countries' ever-changing legislative and tax regulations, particularly when workforces contain individuals with varying immigration status.

- Data Protection: Safeguarding employee payroll details in accordance with data protection laws.

- Payment Currency: Dealing with multiple currencies and foreign exchange rates.

- Benefits: Managing diverse statutory benefits and entitlements across different countries.

- Compensation Standards: Addressing salary disparities and market norms across borders.

- Worker Categorisation: Understanding the distinctions between employee and contractor classifications to avoid legal penalties.

If not effectively managed, these challenges can lead to payroll errors, compliance issues, and reputational damage. That's where an Employer of Record (EOR) can make a significant difference.

What is an Employer of Record (EOR)?

An Employer of Record is a third party service provider that takes on the legal and administrative responsibilities of employing workers in a foreign country. This means that the EOR becomes the official employer of the workers and is responsible for handling payroll, taxes, benefits, and other HR-related tasks. The EOR also ensures that the employees are in compliance with local regulations and tax laws. The company still decides whom to hire, the compensation package, tasks and duties and when to terminate the contract.

Using an EOR can be beneficial for companies that are looking to expand their business globally. By outsourcing the legal and administrative responsibilities of employing workers in a foreign country, companies can focus on their core business activities and reduce the risk of non-compliance and legal issues.

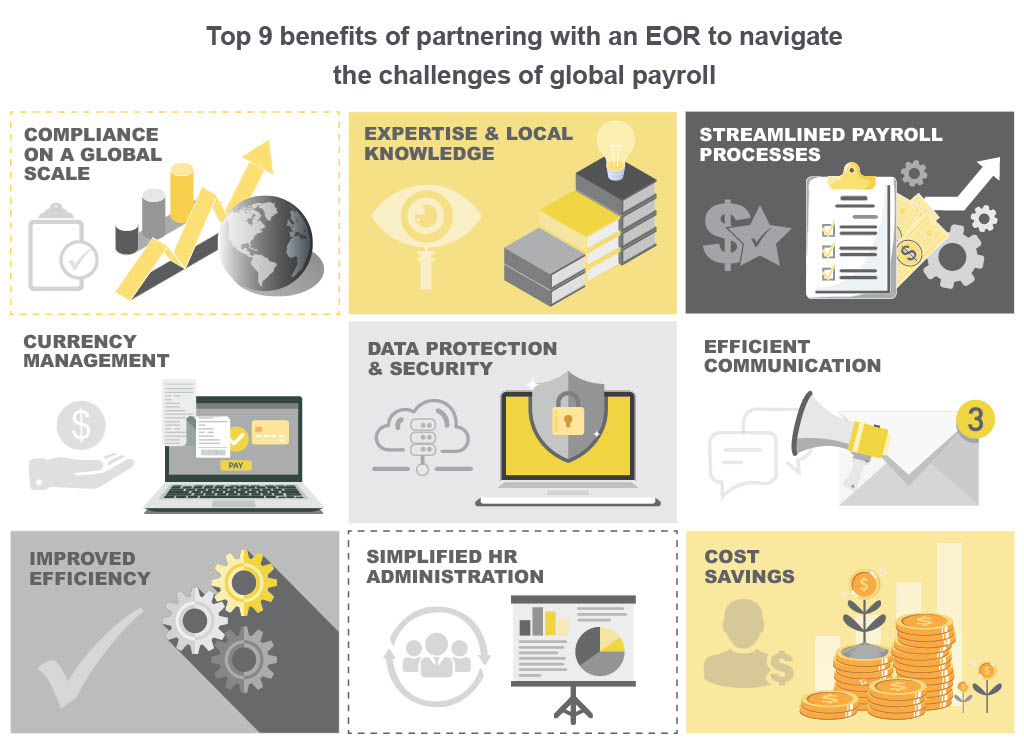

Top 9 benefits of partnering with an EOR to navigate the challenges of global payroll

Partnering with an EOR for global payroll management offers numerous benefits for businesses.

1. Compliance on a Global Scale

Compliance with local tax regulations and employment laws is crucial when operating in multiple countries. An EOR acts as a local expert, keeping current with legislative changes and ensuring payroll processes align with local regulations. By partnering with an EOR, businesses minimise the risk of non-compliance, penalties, and reputational damage.

2. Expertise and Local Knowledge

Choosing the right payroll partner is essential for accurate and efficient payroll management. An EOR brings in-depth knowledge of local labour laws, tax codes, and benefits requirements. Their expertise ensures businesses meet all legal obligations and avoid costly errors and delays.

3. Streamlined Payroll Processes

Managing payroll across multiple providers and systems can be inefficient and time-consuming. An EOR provides a centralised platform for payroll management, simplifying processes and reducing administrative burden. With a single system, businesses can ensure data consistency, standardisation, and streamlined communication across different locations.

A streamlined process ensures accurate and timely payments, which is crucial for maintaining employee satisfaction and trust. Through an EOR, businesses can provide consistent and timely payments to their international workforce, boosting employee morale and minimising turnover risk.

4. Currency Management

Paying employees in different countries often involves dealing with multiple currencies and exchange rates. An EOR can handle foreign currency conversions, ensuring accurate and timely payments to international employees. By staying updated on exchange rates and local tax regulations, an EOR minimises discrepancies and simplifies the payment process.

5. Data Protection and Security

Employee payroll data is highly sensitive and must be protected by data privacy regulations. By entrusting payroll data to an EOR, businesses can ensure compliance with local data protection requirements and mitigate the risk of data breaches.

Global payroll providers prioritise data security, ensuring that employee payroll information is stored securely and accessed only by authorised parties. By entrusting payroll data to reputable providers, businesses can have peace of mind knowing that sensitive information is protected.

6. Efficient Communication

Managing global payroll requires effective communication with stakeholders, including employees, tax authorities, and local partners. An EOR establishes clear communication channels, providing transparency and clarity in payroll operations. This ensures that all parties involved are well-informed and can promptly address any issues or concerns.

7. Improved Efficiency

Outsourcing global payroll to experts allows businesses to focus on their core operations. Global payroll providers leverage advanced payroll software to automate calculations, tax filings, and other compliance-related tasks. This improves efficiency, reduces errors, and frees up valuable time for HR teams.

8. Simplified HR Administration

Managing global payroll involves handling various HR-related tasks. Global payroll services provide comprehensive solutions, including benefits administration, employment compliance management, and payroll processing. This simplifies HR administration, reduces administrative burden, and allows businesses to focus on strategic initiatives.

9. Cost Savings

Outsourcing global payroll can lead to significant cost savings for businesses. By partnering with an EOR, companies avoid the need to establish legal entities in multiple countries, which can be expensive and time-consuming. Additionally, outsourcing payroll reduces the need for in-house payroll specialists, saving on recruitment and training costs.

How to Choose the Right EOR for Your Business

Choosing the right EOR for your business is an important decision. You should consider several factors, such as their:

- EOR experience - a provider who has experience navigating the nuances of payroll in various countries can communicate potential risks, enabling better preparation and risk prevention.

- Reputation and commitment to compliance - look for a provider with their name stamped on the visa. If the EOR uses an external supplier, ensure they have direct contact, embedded personnel, and a solid long-term relationship. This helps prevent additional costs and compliance risks.

- Expertise in your industry – an EOR who has worked within the same sector(s) as you will have a better understanding of your needs.

It is also important to consider the level of support that the EOR provides. Some EORs only provide basic payroll services, whilst others offer a full range of HR services, such as benefits administration and compliance management. Choosing an EOR that can support your business needs is essential to avoid working with multiple partners, which could become costly.

Another factor is the EOR's global reach. If your business operates in multiple countries, choosing an EOR with a worldwide presence that can provide support in all countries where you operate is crucial. It’s also vital that the EOR has in-country representatives on the ground to provide immediate assistance during emergencies if required.

A provider with not only in-country representatives but with a knowledgeable legal, labour and visa support team with the cultural expertise to support and address challenges effectively should also be considered.

Why EORs are the Solution to Global Payroll Challenges

Navigating global payroll challenges requires expertise, compliance, and efficient processes. Businesses can overcome these challenges by partnering with an Employer of Record. An EOR offers comprehensive global payroll solutions, ensuring compliance with local tax regulations, accurate payments, and streamlined HR administration. By leveraging the expertise of an EOR, businesses can focus on their core operations whilst leaving the complexities of global payroll management in capable hands.

NES can be your Employer of Record

Simplify your global payroll processes and unlock the potential of your international workforce.

NES has offices in over 45 countries and decades of experience in international expansion. We can help you to hire employees quickly, compliantly and with minimal risk.

With NES managing your talent, we can resolve your legal entity and employment requirements, ease your payroll burden, manage tax queries and ensure immigration labour law compliance. We are award-winning in compliance and payroll, so your expansion plans are safe.

Contact us to discuss how we can support your international workforce.